michigan gas tax increase 2021

Gretchen Whitmer proposed a large tax hike. A Michigan group Michiganders for the.

Whitmer Takes Flak For Calling 20 Cent Gas Tax Hike Ridiculous

Didnt gas taxes just go up.

. Per MCL 2071010 the owner of motor fuel held in bulk storage where motor fuel tax has previously been paid to the supplier at the lower rate would owe the difference. Michigan At Significant Risk Of A 2021 Tax Hike Mackinac Center Michigan Gas Tax Going Up January 1. At the beginning of the last legislative term Gov.

Introduced by Rep. The pass-through tax increase is estimated to raise roughly 203 million in total revenue in the 2020 fiscal year that starts Oct. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

Michigan Terminal Control Numbers. Mackinac Center Policy Forum Virtual Event. So far in 2021 inflation has been unusually high.

1 2020 and Sept. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. 2022 Estimated Individual Income Tax.

Lets break that down even. A 45-cent tax increase per. The current state gas tax is 263 cents per gallon.

Tuesday April 12 2022. Michigan gas tax increase 2021 Sunday May 29 2022 Edit. Instructions included on form.

Michigan Voters Could Allow Governor to Oversee a 15 Billion Tax Increase by Executive Fiat. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. Michigan gas tax increase 2021 Tuesday May 31 2022 Edit.

To buy 15 gallons that would cost you a total of 6255. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. Federal excise tax rates on various motor fuel products are as follows.

The legislation included a 73-cent increase in the gas tax and a jump in the annual vehicle registration tax. Michigan fuel taxes last increased on Jan. The current state gas tax is 263 cents per gallon.

AAA reports the average price per gallon in Michigan on Tuesday March 8 is 417. FOR CALENDAR YEAR 2021. Even still the yearly increase of the gas tax is capped at 5 regardless.

Michigan Fuel Product Codes - Effective October 2017. 1 and 280 million in 2021. Michigan gas tax increase 2021.

Service Interruption and Import Verification Numbers. To increase the state gasoline and diesel taxes to between 23 cents and 30 cents per gallon depending on the. The pass-through tax increase is estimated to raise roughly 203 million in total revenue in the 2020 fiscal year that starts Oct.

Application for Extension of Time to File Michigan Tax Returns. Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on. It will have a 53 increase due to a.

It will have a 53 increase due to a. Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates Gov Gretchen Whitmer Signals Likely Veto On. 0183 per gallon.

Official Text and Analysis. To repeal a provision of the gas tax law that extends a gas tax increase to specified amounts of fuel held in storage by users or vendors. 2021 Michigan Business Tax Forms.

Michael McCready R on June 17 2015. As such a 45-cent increase. 1 2017 as a result of the 2015 legislation.

The tax on regular fuel increased 73 cents per gallon and the.

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Whitmer To Propose 45 Cent Gas Tax Hike To Fix Roads

Governor Whitmer S 45 Cent Gas Tax Increase 7 Questions

Cut Gas Tax To Make Fuel Cheaper Maryland Georgia Have

U S Energy Information Administration Eia Independent Statistics And Analysis

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Michigan Gas Tax Going Up January 1 2022

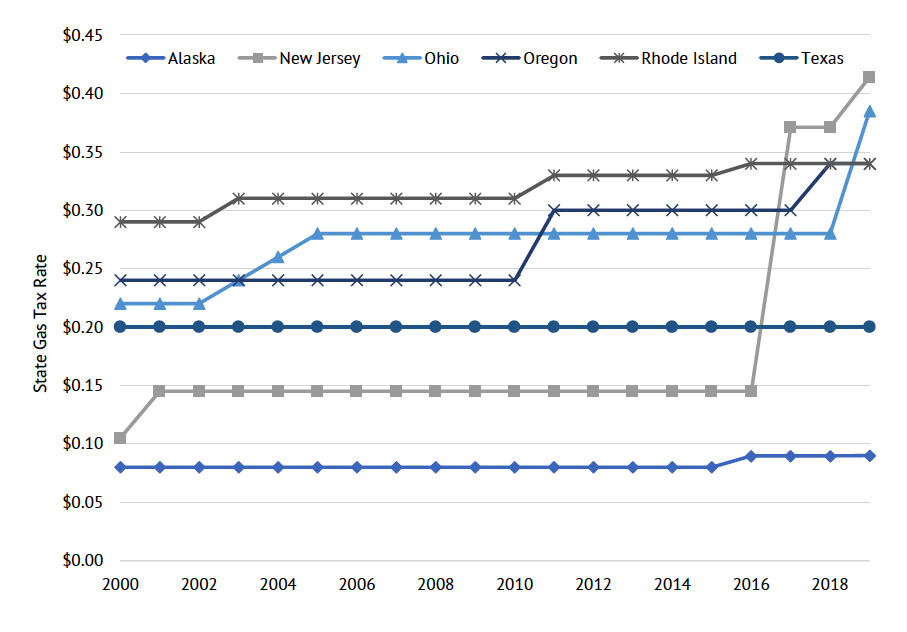

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Would Increasing Gasoline Tax Help Reduce Climate Change Tcu Magazine

Michigan Republicans Announce Plan To Suspend State Gas Tax For Next 6 Months

Governor Whitmer S Proposed Gas Tax Hike Questions Answered

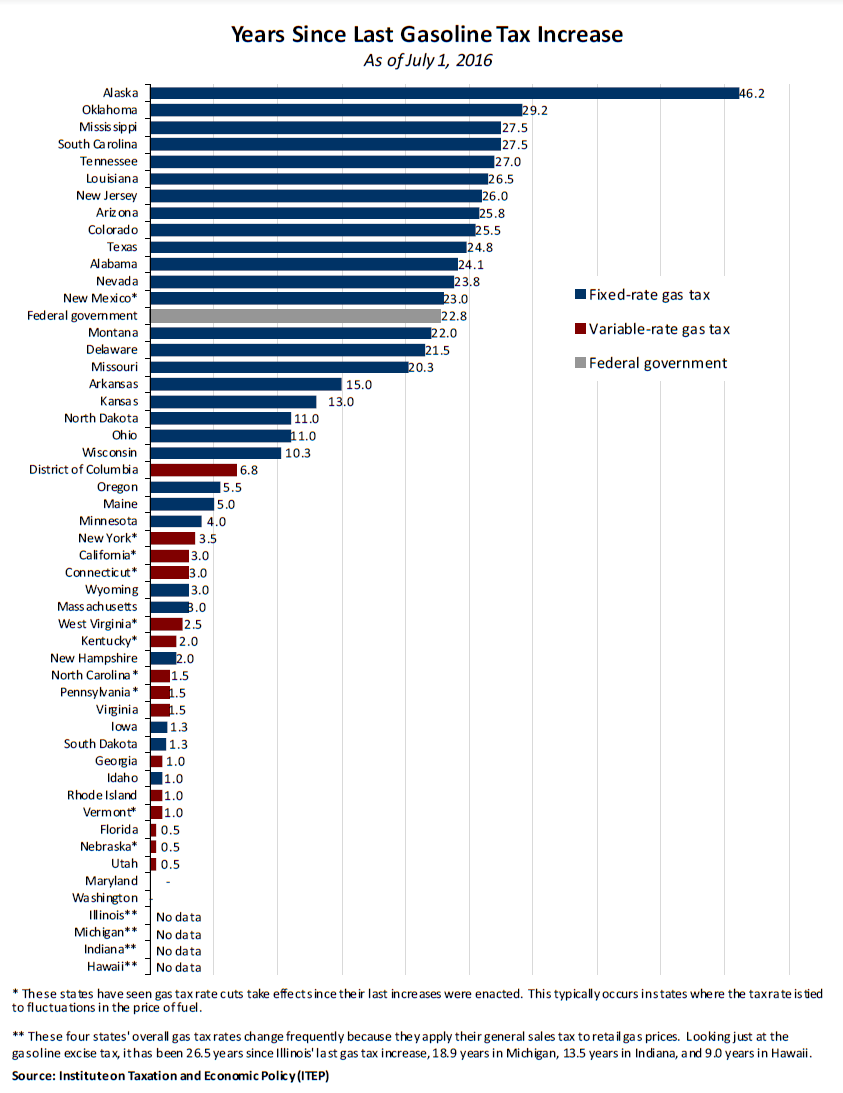

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Chart 12 U S States Are Boosting Their Gasoline Tax Today Statista

Gas Station Association Prepared To Add Truth To Illinois Mandated Gas Tax Sticker Illinois Thecentersquare Com

Whitmer To Propose 45 Cent Fuel Tax Hike That Would Add 2 5 Billion Annually For Roads Crain S Detroit Business

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Illinois Gas Tax How Much Is It And Why Pasquesi Sheppard

How Much Gas Tax Money States Divert Away From Roads Reason Foundation